Extend the Historic Tax Credit.

Posted on | No Comments |

Letter to the Editor: Extend Minnesota’s Historic Tax Credit

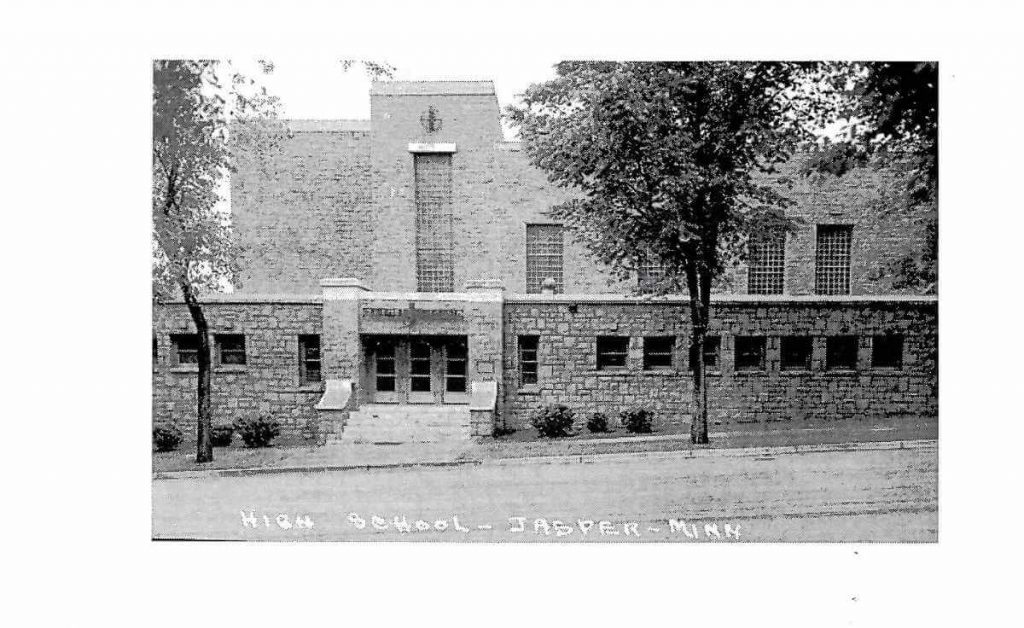

In addition, stacking the state Historic Tax Credit with the Federal Historic Tax Credit can double the impact, and bring in the necessary investment capital for projects like Reclaim Community’s rehabilitation of the Jasper School and Bauman Hall in southwest Minnesota. Rehabilitation of these significant Sioux Quartzite structures with Historic Tax Credit dollars could serve Jasper in endless ways. The infrastructure already exists to convert the former school into housing, office space, retail and arts uses, and create an affordable adaptive reuse multi-use facility that serves residents of Jasper, and stimulate more tax revenue for the entire county. Our community deserves opportunities to reuse and repurpose buildings to fit current needs. It is not only a very critical environmental strategy to address climate change, as it can take between 10 to 80 years for a new, energy efficient building to overcome the climate change impacts created by its construction. Older retrofitted buildings have a 50- to 80-year lifespan vs 30 to 40 for new construction. Buildings built prior to the 1960s, when retrofitted, are more energy efficient than their modern counterparts.

The Historic Tax Credit is one of the most powerful tools in local economic development, job creation and stimulation of entrepreneurship that any community can make, according to 40-plus years of research by PlaceEconomics and the National Trust for Historic Preservation.

If the Minnesota Legislature does not vote to extend the tax credit, we are in danger of losing a proven tool of economic development when we need it most. If we lose this critical program, we lose the ability to improve resiliency and vitality of our community, and the opportunity to create the growth we need to sustain ourselves. Tell Senator Weber you support extending Minnesota’s Historic Tax Credit (SF 724).